Solar Panel Installation in Uttar Pradesh | Solar Power Subsidy in Uttar Pradesh

- Reduce Electricity Bill by 90%

- State Govt. Subsidy of ₹30,000

- Central Govt. Subsidy of Upto ₹78,000

- No Maintenance Needed with Life of 30 years

Start Your Solar Journey  and Save ₹1.08 Lakh!!

and Save ₹1.08 Lakh!!

Why Choose Us?

Self-Cleaning Rooftop Solar System

Automated sprinklers keep solar panels clean, maintaining efficiency & boost energy output

Freyr Energy App

Free quotaions, project tracking and payments, to savings via Smart Energy Optimizer's AI powered insights

24x7 Sales Support

Get expert solar advice and resolutions anytime with our 24×7 support

EMIs Starting From ₹1,466

Own your solar system with easy EMIs & flexible payment tenures ranging from 6-120 months

Design / Detailed Project Report

Get a 3D preview & shadow analysis of the solar system customized to your requirement

Design / Detailed Project Report

Get a 3D preview & shadow analysis of the solar system customized to your requirement.

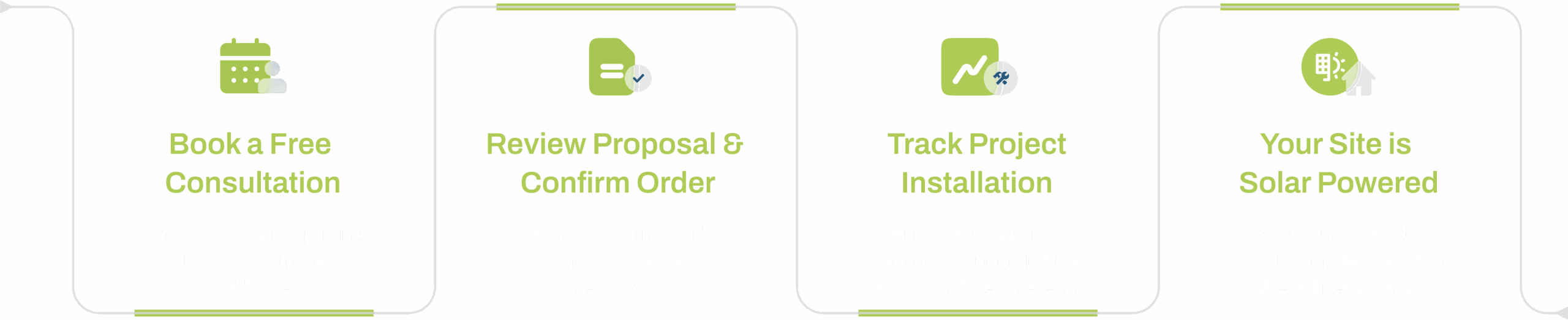

Choose Solar in 4 Easy Steps

Enjoy free clean energy and monitor your generation via Freyr Energy App

Book a Free Consultation

Get system sizing, pricing, subsidy, and finance guidance.

Review Proposal & Confirm Order

Approve costing and design easily via Freyr App.

Track Project Installation

End-to-end project management including subsidy and net-metering.

Your Site is Solar Powered

24x7 support with proactive maintenance via Freyr App.

Choose Solar in 4 Easy Steps

Enjoy free clean energy and monitor your generation via Freyr Energy App

Hear Directly From Our Satisfied Customers

Its Been 1 Year since Freyr Energy installed system on my home. We have not faced any issues and are very happy with their service. Highly recommended Freyr Engery.

Gajendra Shkya

- Indore, Madhya Pradesh

We have installed solar in 4 of our facilities with Freyr Energy and our energy costs has reduced substantially. Our consumers are already appreciating our efforts towards sustainability & net-zero.

Uttam Malani

- Hyderabad, Telangana

Freyr Energy installed 3kW system on my house in Hyderabad. I used to pay ₹ 2,500-3,000 before solar in electricity bills and last month I paid only ₹ 300! Their after-sales is also very quick & reliable.

Mahesh Mishra

- Jabalpur, Madhya Pradesh

Solar Panel Installation in Uttar Pradesh

How is the prospect of having your monthly electricity bills getting slashed down immensely, and you are paying a meagre amount for the next 2 decades? Sounds impossible right?

Freyr Energy has come up with a solution to make this a possibility of providing reliable quality solar rooftop panels for both residential and commercial usage. Our 11+ years of consistent commitments to making India a solar zone have given us a reputable name to reckon with.

We have powered over 11,000+ successful projects with an assurance of comprehensive support. Thanks to our partnering with top solar panel manufacturers in Uttar Pradesh, we are the most reliable names when it comes to providing a complete unit of solar power plant in the state.

Benefits of Solar Power in Uttar Pradesh

Reduced power bills:

Uttar Pradesh solar plant at homes contributes to having lesser electricity bills month on month. The right sized solar panels with adequate maintenance are responsible for saving a ton of money for at least 20+ years.

Go green:

Solar system for home in Uttar Pradesh installation allows users to be a part of the green revolution. This is because solar energy offers a carbon-neutral power generation alternative, which is beneficial for a long time use case.

Cost effective installation:

With the help of solar panel subsidy in Uttar Pradesh in the offering, any person can install these panels with an assured reduction in billing of the total solar panel cost with an attractive ROI of around 3–5 years.

Our Solar Installation Services

Solar Panels for House in Uttar Pradesh

As you choose to set up a new solar panel in your home, the state government encourages schemes that offer solar system for home subsidy in Uttar Pradesh for installation of the panels. Additionally, we at Freyr Energy are always ready to help you with your endeavours in making the most of the program.

One of the biggest takeaways of having a solar system in Uttar Pradesh is that the value of the property increased. The real estate values of houses installed with solar power units have always fetched more prices than the ones without the panels.

Solar Panels for Business in Uttar Pradesh

Businesses can maximise their profitability with the usage of solar panels. Although the size of the panels varies from use case to other factors involved, a solar power panel can minimise the large expense of electricity bills and increase revenue. Additionally, with the installation of solar panels, businesses can reduce any business downtime when there is a possibility of power outages. In the end, the cost of electricity bills is increasing over time, and with solar power, your business is immune to any higher payment of electricity bills.

Types of Panels available today

Here are two types of panel systems available, including:

On-grid

On grid solar panels are the ones attached to the main power grid. Any additional power generated can be distributed via the grids that could be used for other commercial purposes. These grids are the right choice for areas that see frequent power cuts and don’t have dedicated power backup systems. With this, homes are assured to conserve extra energy and a continuous power supply is assured.

Off-grid

Unlike on-grid, off grid power panels are independent of the power grid. They have a separate storage and backup unit, which allows for storing the excess power generated by solar panels for usage at non sun hours. This can be used for common residential use cases.

Solar Subsidy in Uttar Pradesh:

Solar system subsidy in Uttar Pradesh is provided by Uttar Pradesh New and Renewable Energy Development Agency (UPNEDA). The solar subsidy Uttar Pradesh is alongside the popular Central Financial Assistance provided by the Central Government on the installation of residential solar panels

Here is how to apply for both the Uttar Pradesh solar subsidy schemes:

- Visit the portal PM Surya Ghar and https://solar.upneda.in/

- Fill out the registration box with all the necessary details and check on Apply for government subsidy for solar panels in Uttar Pradesh.

Solar Panel Price Uttar Pradesh

Estimated cost of Installation

In reality, there are several sizes, types, and capacity differences between solar panels that one can install on their rooftop solar Uttar Pradesh. Here are some factors that determine the solar system price in Uttar Pradesh, including:

- Size

- Type of panels

- Installation type (rooftop or ground)

- Application of subsidies

Price range

Check out the general price range for solar panels after applying subsidies:

| Plant Capacity | Price |

|---|---|

| 2kW solar panel price in Uttar Pradesh is: | INR 90,000-1,10,000 |

| 3kW solar panel cost in Uttar Pradesh: | ₹ 1,50,000 – ₹ 1,80,000 |

| 5kW solar panel cost in Uttar Pradesh: | ₹ 2,80,000 – ₹ 3,10,000 |

Why choose us for Solar Panel Installation in Uttar Pradesh?

At Freyr Energy, we believe it’s our duty to make India a comprehensive solar power-user nation. With the abundance of sunlight for more than 300 days on an average, this is one of the most resourceful sources of energy. At Freyr Energy, we make the most of this and install quality rooftop solar in Uttar Pradesh. Our teams of experts are always in your service with unperturbed assistance and dedication. Here are some reasons to choose us:

Dependable Name: We have acquired several awards and recognition for being a consistent name in the world of solar panel installation across Uttar Pradesh and in several parts of India.

Top-quality panels: As a leading solar company in Uttar Pradesh, we boast of providing top-quality panels that have longevity of decades. With basic inspection and maintenance, these panels could last for decades.

Find Solar Services Near Your City

FAQs

Have any specific Question ?

Connect with our solar specialists for personalized guidance.

What is the subsidy for 5kW solar system in UP?

The 5kw solar panel price in Uttar Pradesh could be calculated by the subsidy range list:

- The Central subsidy offered is ₹78,000 (maximum limit)

- The Uttar Pradesh solar subsidy offered is ₹30,000

Therefore, the total amount for a 5kw solar panel price in Uttar Pradesh with subsidy is INR 1,00,000/-

What is the price of a 3kW solar panel in Uttar Pradesh?

The typical cost for a 3 kW solar system in Uttar Pradesh is ₹ 2,30,000 to ₹ 2,40,000, based on current market ranges for that size.

How much is a 2kW solar system in UP?

A 2 kW solar system is typically priced around ₹ 1,80,000 to ₹ 1,90,000 in UP, excluding subsidy.

Is there any subsidy on solar panels in Uttar Pradesh?

Yes. UPNEDA provides a personalised subsidy for all residents of the state, who are planning to install rooftop solar panel in Uttar Pradesh.

How to apply solar rooftop scheme 2025?

Here is the process on how to apply for solar rooftop yojana:

- Check the eligibility

- Have the required documents ready

- Submit application via the portal

- Initiate a site inspection from the officers

Once approved, check your bank account for solar panel subsidy Uttar Pradesh updates.

How many AC can run in a 3kW solar system?

With a 3kW solar panel system installed in your house, you can use it to power one 2 ton AC, alongside running other household electronic appliances and gadgets.